Learn about 10 Types of Corporate Strategies Using Capitalism Lab

1. Forward Integration

This strategy involves a company gaining ownership or increased control over distributors or retailers.

In Capitalism Lab, a student can learn about forward integration by acquiring or starting a retail store to sell the products produced by their manufacturing business. For example, if the student owns a clothing manufacturing company, they can start a clothing retail store to sell their products directly to the consumers. By doing so, the student can have more control over the distribution and sale of their products, reduce the dependence on external retailers, and increase their profit margins.

2. Backward Integration

This approach involves seeking ownership or increased control of a firm’s suppliers.

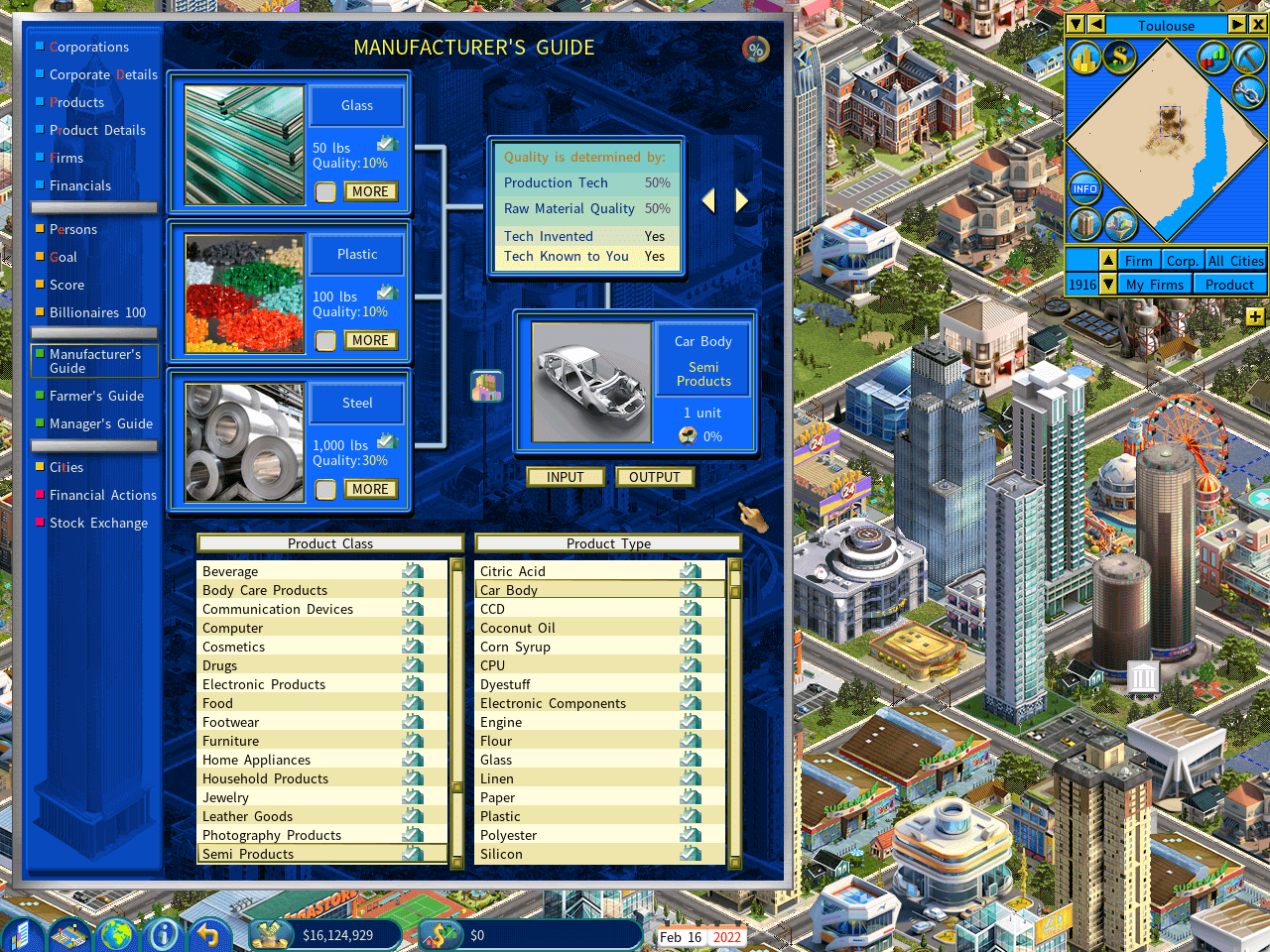

In Capitalism Lab, a student can learn about backward integration by acquiring or starting a company that produces the raw materials needed for their manufacturing business. For example, if the student owns a car manufacturing company, they can start a steel production company to ensure a steady supply of raw materials and reduce their dependence on external suppliers. By doing so, the student can have more control over the production process, reduce costs, and improve the quality and reliability of their products.

3. Horizontal Integration

This strategy involves seeking ownership or increased control over competitors.

In Capitalism Lab, a student can learn about horizontal integration by acquiring or merging with a competitor that operates in the same industry and produces similar products. For example, if the student owns a chocolate bar manufacturing company, they can acquire or merge with another chocolate bar manufacturing company to expand their market share, eliminate competition, and achieve economies of scale.

4. Market Penetration

This strategy involves increasing market share for present products or services in present markets through greater marketing efforts.

In Capitalism Lab, a student can learn about market penetration by increasing their marketing efforts to promote their products and attract more customers. For example, if the student owns a soft drink manufacturing company, they can invest in advertising campaigns to increase awareness and demand for their products. By doing so, the student can increase their market share, improve their brand recognition, and generate more revenue.

5. Market Development

This strategy involves introducing present products or services into new geographic areas.

In game Capitalism Lab, a student can learn about market development by expanding their business operations into new geographic areas. For example, if the student owns a clothing manufacturing company that operates only in the domestic market, they can explore opportunities to sell their products in foreign markets. By doing so, the student can reach a larger customer base, diversify their revenue streams, and reduce their dependence on any single market.

6. Product Development

This approach involves seeking increased sales by improving present products or services or developing new ones.

In the simulation game Capitalism Lab, a student can learn about product development by creating and launching new products or improving existing ones to meet the changing needs of their customers.

For example, if the student owns a desktop computer manufacturing company, they can invest in research and development to continue enhancing product quality. As a result, the student may differentiate their products from those of their competitors with higher quality, increasing their market share and profitability.

They can also create new laptops and tablets to target specific market segments.

7. Related Diversification

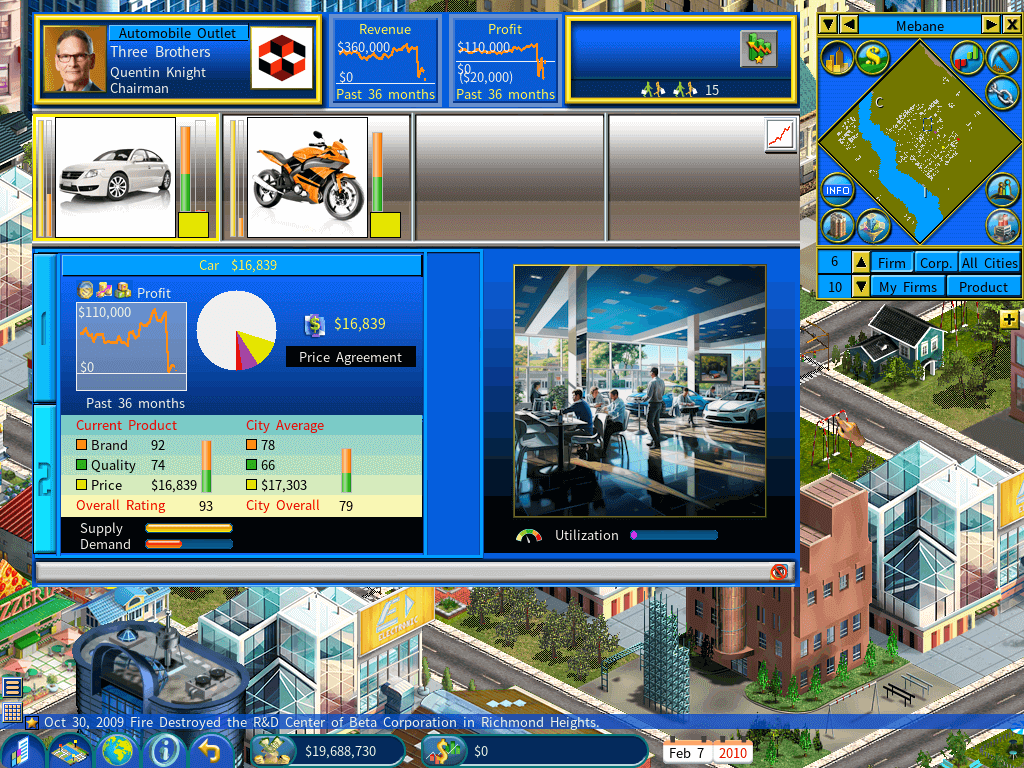

A student can learn about Related Diversification by playing Capitalism Lab and focusing on the automotive industry. In the game, the student can start with a company specializing in car manufacturing. As they progress, they can diversify into motorcycle production, leveraging their existing knowledge and resources in the automotive sector.

This expansion allows the student to understand how Related Diversification works by using the company’s core competencies in vehicle engineering and production to enter a closely related market. They will experience how economies of scale and scope can be achieved by sharing resources like research and development, supply chains, and marketing strategies between cars and motorcycles.

This move into motorcycles, while maintaining a single brand for both cars and motorcycles, allows the student to understand the nuances of leveraging brand reputation and marketing strategies across related products. They learn how a strong brand in one sector can positively influence customer perceptions in a related sector, thus facilitating entry into the motorcycle market.

The student also experiences the challenges of maintaining consistent brand values and quality standards across different but related product lines. They will have to make strategic decisions on resource allocation, research and development, and marketing, ensuring that both the car and motorcycle divisions reinforce each other under the unified brand.

Through this simulated experience, the student gains a practical understanding of how Related Diversification can lead to business growth while mitigating risk by staying within a familiar industry. This hands-on approach in a controlled, simulated environment like Capitalism Lab makes complex strategic concepts more accessible and engaging for students.

8. Unrelated Diversification

Unrelated Diversification is a corporate strategy where a company expands into new businesses that are not related to its current operations. In the game Capitalism Lab, a student can learn about this strategy by starting a business in one industry and then using the profits from that business to expand into a completely different industry.

For example, a student could start a clothing company and once it becomes profitable, use those profits to start a new business in the technology sector, such as a manufacturer of personal computers. This would demonstrate the concept of unrelated diversification, as the two businesses have nothing in common and are not interconnected in any way.

Through this process, the student can learn about the advantages and disadvantages of unrelated diversification. For example, they may find that diversification helps to spread risk and increase profits, but also requires a significant amount of resources and management attention. Additionally, the student can experiment with different approaches to diversification and see which ones are most effective in different market conditions.

9. Retrenchment

Retrenchment, which involves scaling down operations to become more financially stable, can be experienced in the game by encountering scenarios where the player’s company faces financial difficulties or market challenges.

For example, the student can simulate a scenario where their company is overextended, facing declining profits, and high operational costs. In response, they can implement retrenchment strategies such as closing unprofitable divisions, selling off non-core assets, or restructuring the organization to streamline operations. This practical engagement allows students to understand the complexities and impacts of retrenchment, including employee layoffs, reduced product lines, and focusing on core business areas.

By analyzing the game’s detailed financial reports and market feedback, students can assess the effectiveness of their retrenchment strategies. They learn to balance short-term survival with long-term strategic positioning, a crucial aspect of strategic management. Thus, Capitalism Lab provides an interactive and immersive learning environment for understanding and applying the concept of retrenchment in corporate strategy.

10. Divestiture

One of the corporate strategies that players can learn about in Capitalism Lab is divestiture, which involves selling off a business unit or division.

For example, a student can create a company in Capitalism Lab that operates in multiple industries, such as electronics and clothing. As the company grows, the student may realize that the electronics division is not performing as well as the clothing division and is draining resources from the more profitable business unit.

In this case, the student can choose to divest the electronics division by selling it to another company, spinning it off as a separate entity, or shutting it down. This decision can free up resources and allow the student to focus on growing the more profitable clothing division.

Through this hands-on experience, the student can learn about the benefits and drawbacks of divestiture as a corporate strategy, including how it can improve financial performance, reduce risk, and enable companies to focus on their core competencies. Additionally, the student can gain a deeper understanding of how to analyze a company’s portfolio, identify underperforming business units, and make strategic decisions to optimize performance.

Understanding the Differences between Retrenchment and Divestiture

Retrenchment and divestiture are two corporate strategies that companies use to improve their financial performance, but they differ in their approach and focus.

Retrenchment involves cutting costs and improving efficiency within a company’s existing operations. This can include reducing the workforce, closing underperforming facilities, streamlining processes, and selling off non-core assets. The goal of retrenchment is to improve profitability by reducing expenses and increasing productivity. Retrenchment can be a short-term or long-term strategy, depending on the company’s goals and market conditions.

Divestiture, on the other hand, involves divesting a business division that is no longer core to the company’s operations or is underperforming. This can be done through a sale to another company, a spin-off, or a liquidation. The goal of divestiture is to free up resources and focus on the company’s core competencies. Divestiture can also be used to reduce risk by eliminating business units that are exposed to volatile markets or regulatory risks.