Banking Company Strategy

By Stylesjl

Banking Overview

A bank is an institution that accepts deposits of money from the public and then loans that money to the public. Banks also tend to perform other functions such as facilitating financial transfers between depositors and other banks or institutions along with other services (such as Insurance, Currency Exchange, Stock Market Brokerage, Financial Planning, etc.).

In Capitalism Lab the banking system is simplified into a more simple and traditional Deposit and Loan business model, which means that your only method of making money through a bank is via loans. Don’t let this simplicity fool you however: The Banking in Capitalism Lab can be quite tricky to manage. This guide will help to explain how to use the Banking Company to make a large amount of profit and to keep the risks of major losses as low as possible.

This guide will be broken down into the following sections:

- Basic Banking Concepts and Terminology and what it means.

- Banking Difficulty Settings (along with how they interact with standard game settings).

- Recommended difficulty settings.

- Picking the Banking Headquarters and Branch Locations.

- Starting Strategy.

- Setting up banks after establishing a prior company.

- Bank Troubleshooting.

- Conclusion.

Banking Concepts and Terminology

Note: For a basic overview see the Banking and Finance DLC page.

Banks in Capitalism Lab use terminology and ideas lifted from the real world banking and finance industry. I will specify what these terms are and what they mean from an in-game perspective.

Banking Headquarters

This is the firm that houses your banking headquarters where you can control your bank and all of its branches. All profits and losses of your bank are consolidated into the banking headquarters. Any Corporate Taxes you pay for profits will also be collected by the city the bank headquarters is located in (in the City Economic Simulation DLC only).

See the Bank HQ page for more details on how the HQ works.

Bank Branch

These are the individual, customer facing firms that collect deposits from the public and provide loans. The more branch coverage you have the more deposits and loans you can make to the public.

See the Bank Branch page for more details on how the bank branches work: https://www.capitalismlab.com/banking-dlc/bank-branch/

Branch Deposits

Deposits made from the general public in a bank branch. The amount of money that will be deposited will depend on the local customer traffic to the branch as well as the Savings Modifier (see Savings Rate Modifier in the difficulty settings). It is also affected by the Brand, Service Quality and Depositor Interest Rate.

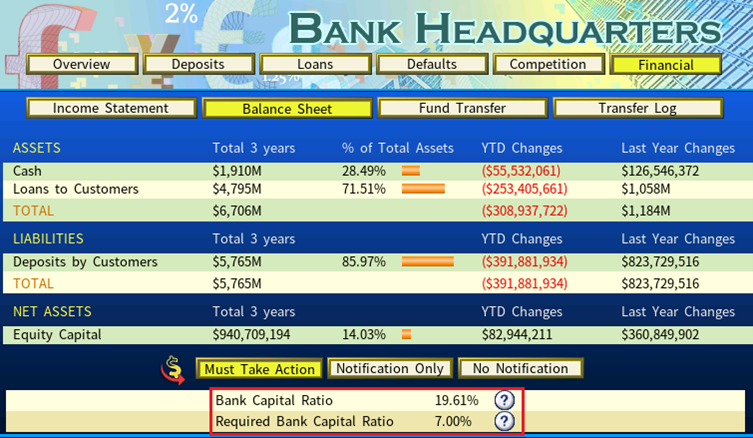

Capital Ratio

The capital ratio is the amount of Equity Capital your bank has relative to the amount of loans that have been issued. In this case the Equity Capital refers to the assets your bank owns that are not customer deposits. For example if you inject $500 million into the bank and depositors add $10.5 billion then your Equity Capital is $500 million even if you have $11 billion in cash. If you then lend $10 billion of this cash then your Capital Ratio will be 5%.

Credit Rating

This is the rating given to all potential borrowers of money that determines the potential risk that they will not pay back what has been lent to them. The ratings are as follows (from lowest to highest risk):

- AAA

- A

- BB

- CCC

- C

Corporate Deposit

In game this is called Deposits from HQ and it simply means all the deposits that come from in game corporations or in-game persons (such as the player depositing their personal money in a bank). No branches are required to take these deposits.

Loan Demand

This is the total demand for loans. If the loan demand has reached its limit then no new loans will be given as no-one else is willing to borrow any more money. This limit can be reached either due to the number of customers serviced by a bank branch in an area reaching their limit or it could be an overall limit imposed by the total size of the economy (if Realistic Loan Demand is set to Yes).

Corporate Loans

In game this is called Loans from HQ and it simply means all of the loans made to in-game corporations. No branches are required to make these loans. The interest paid on these loans depends on that corporation’s credit rating.

Loans-to-Assets Ratio

This is how much of the bank’s overall assets have been lent out. For example if this is 90% and you have 100 million worth of assets then you will have 10 million in cash and 90 million will be in loans. The Maximum Loans-to-Assets Ratio is a limit on how high this number can go before the bank will automatically stop lending more money.

Additional Concepts

Note there are additional concepts than those explained above. The following articles will explain what most of those are:

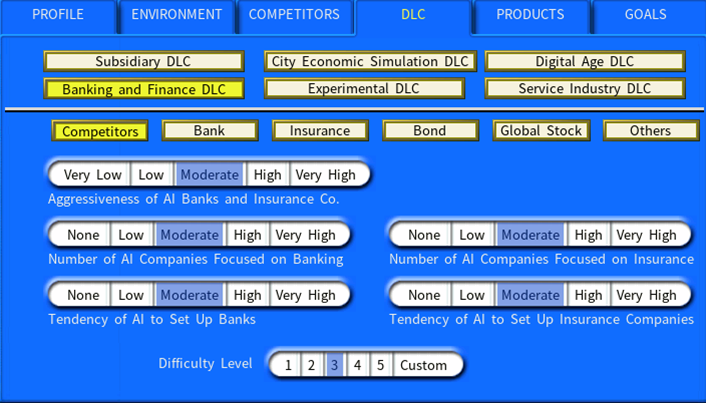

Banking Difficulty Settings

There are a number of difficulty settings that greatly affect the level of profit and risk of losses for banks. An explanation of what every difficultly setting will do has been provided below:

Competitors

Aggressiveness of AI Banks and Insurance Co.

Controls the behaviour of your AI Competitors in terms of how aggressively they will compete against you in terms of acquiring market share. For example a more aggressive banking AI will spend more on Advertising, Staff Training, Raising Deposit Interest and building Branches in order to take away as much market share from their competitors as possible.

Number of AI Companies Focused on Banking

This controls how many companies will start the game as banking companies; a higher number means that a greater portion of AI competitors will be banks.

Tendency of AI to Set Up Banks

This controls how many companies will enter the banking industry if they are successful and profitable in other industries and wish to diversify their holdings. This will not affect the number of banks at the start of the game.

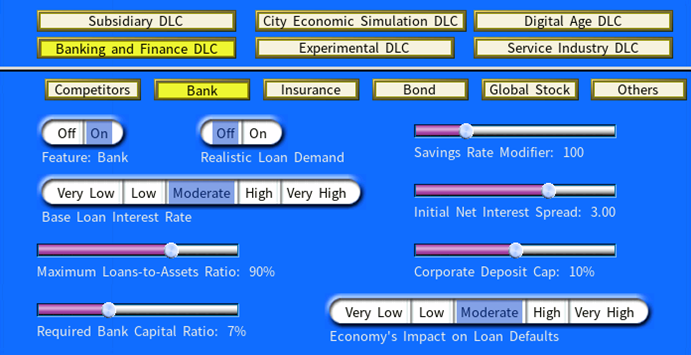

Bank

Feature: Bank

This determines if Banks will be featured in the game or not. If Banks are switched off no-one can create a banking company and all loans will come from a single in-game bank (which was the default behaviour of Capitalism Lab before this DLC was introduced).

Realistic Loan Demand

This determines if the total demand for loans will be limited by the size of the economy. If this is switched off there will still be limits to loan demand but those limits will be much higher. This feature is used to limit the overall profitability of banks. Note that Realistic Loan Demand has no effect on loans made to corporations (i.e. they can borrow as much as the bank’s available cash or the corporate credit limit allows).

Base Loan Interest Rate

This determines the ‘Normal’ interest rate in the economy. This rate will affect all interest paying assets such as Bonds, Deposits and Bank Loans. The actual in-game interest rate can still change depending on the decisions of the Central Bank.

Note: Setting this to a very high level will not necessarily make your bank more profitable as you will still need to pay depositors higher rates.

Maximum Loan-to-Assets Ratio

This will determine how much of the bank’s overall assets are permitted to be lent out. It should be noted that you or an AI company can voluntarily choose to set this to a lower level if you want to reduce your risk further, however this setting prohibits you from setting it any higher.

Required Bank Capital Ratio

This will determine how much of the bank’s own assets (Equity Capital) must be kept in reserve. The Equity Capital is different to the overall assets in the sense that Customer Deposits belong to someone else and therefore do not count as equity. If your equity capital falls below this level then no new loans may be issued.

Savings Rate Modifier

This controls the overall amount of money that members of the general public will deposit into your bank branches. This usually makes the game easier if this is set to a high level as there will be more money to lend from a bigger depositor base (although you may have some difficulty with handling the Capital Ratio requirements if the amount of deposits is too great).

Note: This has no effect on corporate deposits into banks.

Initial Net Interest Rate Spread

This determines the ‘Normal’ interest rate difference between the deposits in a bank and the loans created by the bank. For example if you pay your depositors 2% and loan it out at 5% then your Spread is 3%. A higher spread makes banks more profitable.

It should be noted that the spread in the game can vary based on the interest rate you choose to pay to deposits as well as the types of loans you give so this setting only controls the ‘Normal’ interest rate spread.

Corporate Deposit Cap

This sets the maximum amount of money that a single corporate depositor can make in a bank relative to other corporate depositors. This is to ensure that no single corporation can pose too much of a risk to a bank if it suddenly withdraws their deposit(s). It should be noted that this setting does not affect the amount of money that corporate depositors can deposit in general.

Economy’s Impact on Loan Defaults

This will determine the amount of loans that will default in the event of an economic downturn. A high level will mean that banks must be much more conservative with their loan portfolio, especially if the economic environment is very volatile.

Other Difficulty Settings

These difficulty settings are not directly related to banks, but they do indirectly affect banks by changing the business environment:

Your Starting Capital and Competitors Starting Capital

It is recommended that your starting capital be set at High or Very High. If your starting capital is any lower it may be impossible or at least a very bad idea to start with a bank until you accumulate more capital from another line of business.

The same rule applies to your competitors, their capital base should start from at least high or otherwise they will not build banks.

Inflation and Inflation Strength

Switching on inflation at normal levels will erode some of the gains that your bank will make from loans. For example if you have to pay 3% to depositors and you loan at 6% then in theory you should gain 3% but if inflation is at 2% then in real terms you will only gain 1%. Switching off or reducing inflation gets rid of this effect or lowers the impact.

Boom-Bust Cycle Volatility

If the economy is more volatile then each time there is a downturn the defaults on loans will be much higher. If this is set to High and Economy’s Impact on Loan Defaults is set to Very High then this could lead to a huge number of loan defaults.

Number of Competitors

This determines the overall number of companies that will be in the game, more competitors also means more companies to compete with your bank. On the plus side however more companies also expands the economy, which can increase the overall loan demand.

Recommended Difficulty Settings

The following settings are suggested for players that want to create custom games involving the banking industry. These settings will be different for the official Banking and Finance DLC scenarios.

Very Easy/Beginner

My recommendation is to use the following difficulty settings to get an idea of how it feels to run a bank, but without other complicating factors such as competition or high loan default rates. This is highly recommended for players new to banking.

- Number of AI Companies Focused on Banking = None

- Tendency of AI to Set Up Banks = None

- Realistic Loan Demand = No

- Base Loan Interest Rate = Moderate

- Maximum Loan-to-Assets Ratio = 90%

- Required Bank Capital Ratio = 1%

- Savings Rate Modifier = 100%

- Initial Net Interest Rate Spread = 4%

- Economy’s Impact on Loan Defaults = Very Low

- Your Startup Capital = Very High

- Inflation and Inflation Strength = Normal

- Boom-Bust Cycle Volatility = Low

Easy

If you have mastered the basics of banking then this mode will make the game a bit harder. You will experience competition as well as the threat of potential losses from defaults if you make high risk loans.

- Aggressiveness of AI Banks and Insurance Co = Low

- Number of AI Companies Focused on Banking = Moderate

- Tendency of AI to Set Up Banks = Moderate

- Realistic Loan Demand = Yes

- Base Loan Interest Rate = Moderate

- Maximum Loan-to-Assets Ratio = 90%

- Required Bank Capital Ratio = 5%

- Savings Rate Modifier = 100%

- Initial Net Interest Rate Spread = 4%

- Economy’s Impact on Loan Defaults = Low

- Your Startup Capital = Very High

- Inflation and Inflation Strength = Normal

- Boom-Bust Cycle Volatility = Moderate

- Number of Competitors = 25

Medium

Similar to the default game settings, with a few tweaks:

- Aggressiveness of AI Banks and Insurance Co = Moderate

- Number of AI Companies Focused on Banking = Moderate

- Tendency of AI to Set Up Banks = Moderate

- Realistic Loan Demand = Yes

- Base Loan Interest Rate = Moderate

- Maximum Loan-to-Assets Ratio = 90%

- Required Bank Capital Ratio = 5%

- Savings Rate Modifier = 100%

- Initial Net Interest Rate Spread = 3%

- Economy’s Impact on Loan Defaults = Moderate

- Your Startup Capital = Very High

- Inflation and Inflation Strength = Normal

- Boom-Bust Cycle Volatility = Moderate

- Number of Competitors = 25

Hard

If you are looking for a challenge:

- Aggressiveness of AI Banks and Insurance Co = Very High

- Number of AI Companies Focused on Banking = Very High

- Tendency of AI to Set Up Banks = Very High

- Realistic Loan Demand = Yes

- Base Loan Interest Rate = Moderate

- Maximum Loan-to-Assets Ratio = 90%

- Required Bank Capital Ratio = 10%

- Savings Rate Modifier = 100%

- Initial Net Interest Rate Spread = 2%

- Economy’s Impact on Loan Defaults = Very High

- Your Startup Capital = Very High

- Inflation and Inflation Strength = Normal

- Boom-Bust Cycle Volatility = High

- Number of Competitors = 50

Picking the Banking Headquarters and Branch Locations

Headquarters

If you wish to setup a bank your first action will be to establish a Banking Headquarters. A good location for the headquarters will have the following characteristics:

- City has a low land cost and wage rate.

- Location is on the outskirts of a city where the land is cheap.

There is no point building the headquarters in the middle of a city as the land is more expensive and the location of the headquarters is irrelevant to the functioning of the bank.

Once the headquarters is built it can only be demolished if all branches of the bank have been destroyed and the amount of money the bank has is enough to repay all depositors.

Branches

You can set up branches anywhere that the land is available. The criteria for setting these up are the same as that of retail shops (i.e. make sure it is a high traffic location).

Starting Strategy

This strategy will be focused on what to do if you wish to start the game with a banking company and use it as your only source of profit (at least for several years). This guide will assume that you are using the Medium difficulty settings.

Step 1: Establishing your Headquarters and first few branches

Your first task should be to build the Banking Headquarters on the outskirts of a city with a low wage rate, to keep the costs as low possible. Once you have done this build a few bank branches, no more than 2 or 3 should be built to keep the costs as low as possible.

Your bank will be very vulnerable in the first stages to having the Capital Ratio fall below the required amount, which is why it is very important to keep the overhead as low as possible so that your bank can build up its equity amount. You can see your Capital Ratio here:

Before you unpause the game and start make sure you do the following:

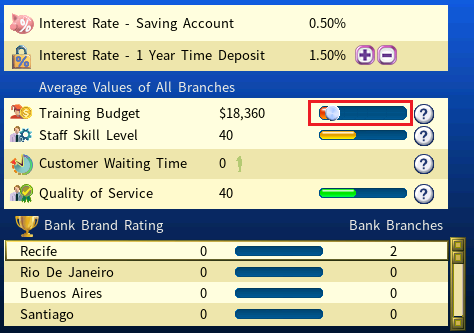

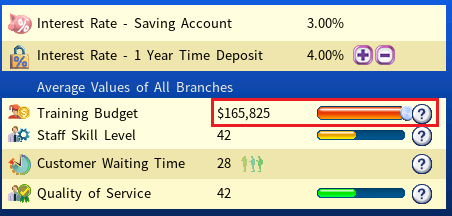

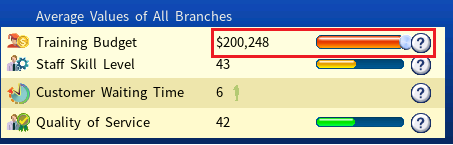

– Set a small training budget for your branches (note you can do branding and the changing of the deposit rate later):

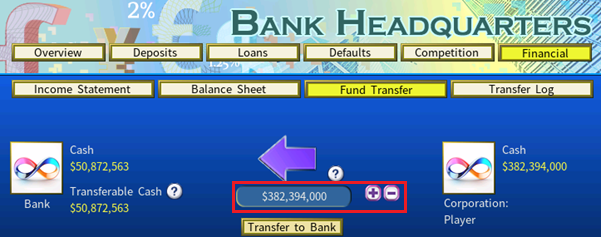

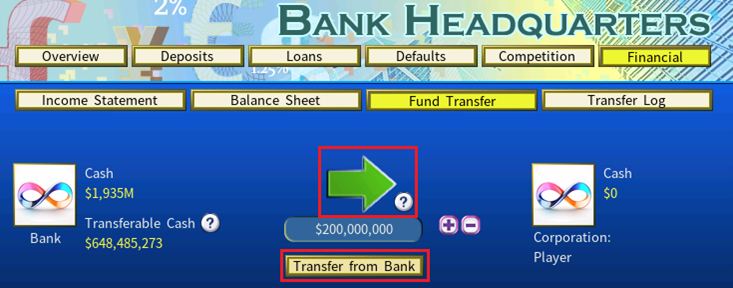

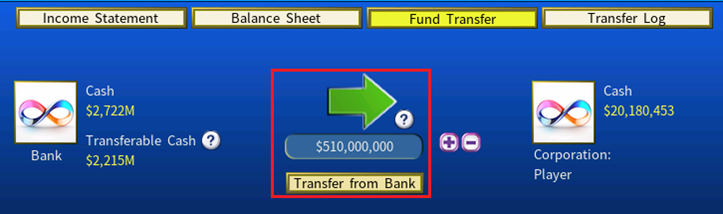

– Transfer all of your money into the bank to increase the equity capital as much as possible:

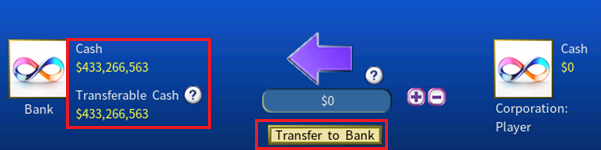

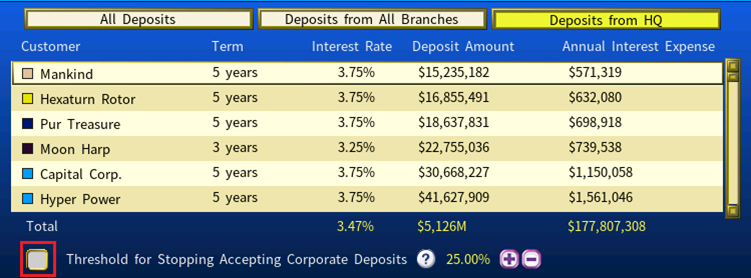

You should also limit the amount of corporate deposits being made to your bank as well, to stop too much money flowing into your bank all at once and causing your Capital Ratio to fall below the required minimum.

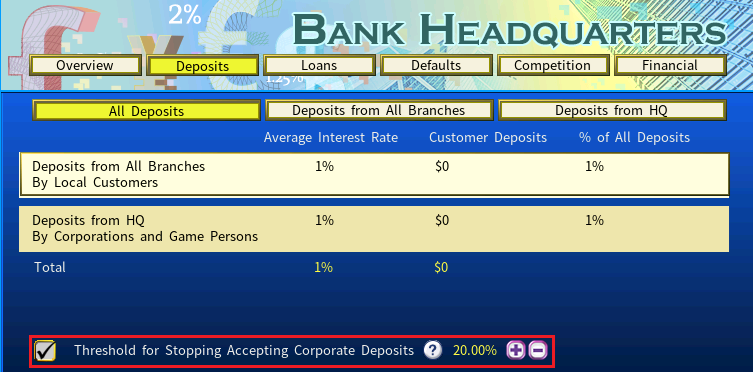

Unpause the game and after the first month loans will start being issued and you will start to make a profit:

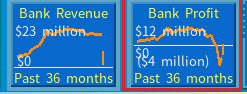

At this point, being mindful of the Capital Ratio you can start to spend more money on improving your bank, such as increasing the training budget and advertising as well. Be careful however, if you start to see the profit levels dipping too low or the capital ratio getting too close to the minimum threshold then you should cut expenses immediately:

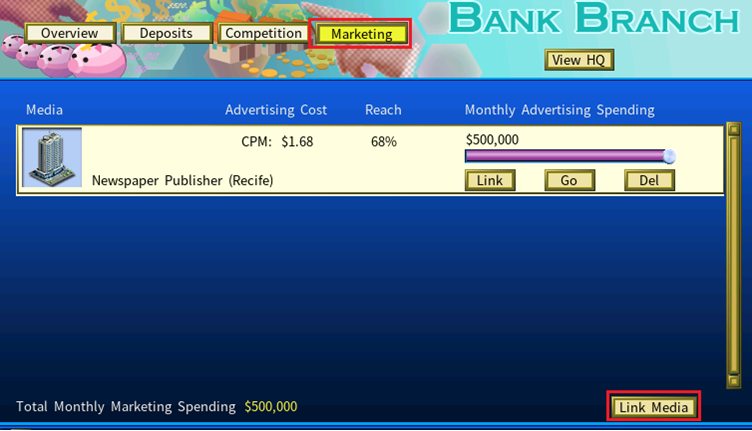

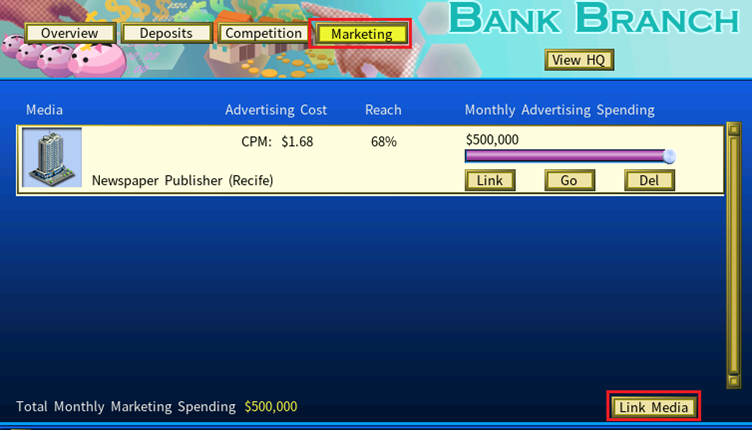

Note that marketing must be done through Bank Branches as brand is calculated per city (unless you are using the Digital Age DLC, in which case you can advertise for all cites via an Internet Company):

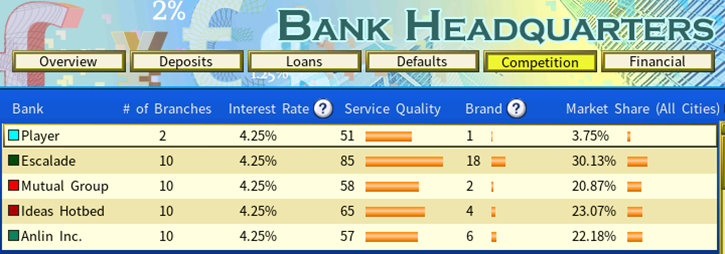

Now that your bank is up and running it is time to size up the competition and see how they are doing:

As you can see, we have a very small market share. Let’s start increasing it so that we can now attract more deposits

First step is to remove or raise the Corporate Deposit Cap. But remember to only do this if your Capital Ratio is healthy.

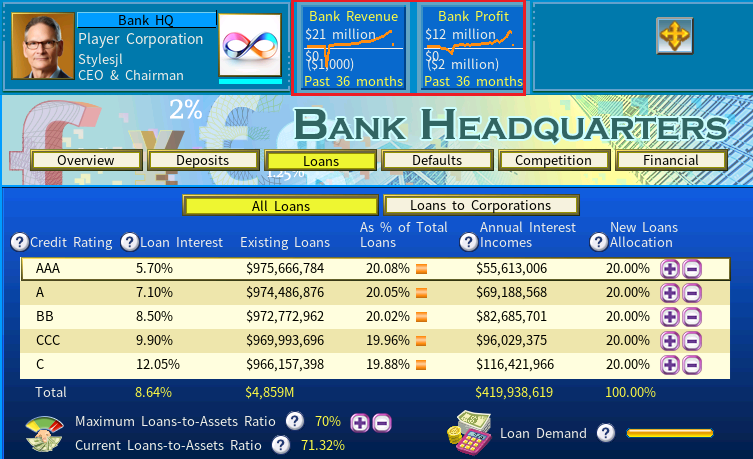

Then we will pull some money out of the bank so that additional branches can be built (note if your Transferable Cash is very low that is because your Capital Ratio is too close to the minimum, do not expand until you fix this problem):

Start building branches in other cities. Once you have built them all set the Training Budget for all of them at the same in the HQ:

Be sure to have one branch per city do the marketing as well:

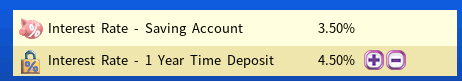

You can also try raising the deposit rate as well, which will attract more deposits. However keep in mind that this will raise the costs for most of your existing deposits, so expect to see a short to medium term decline in profitability if you increase the deposit interest rate.

Note if you start to see your profits dip significantly then make sure that you cut your expenses, remember that the key is to expand but to be cautious about it.

If you encounter problems along the way see Bank Troubleshooting.

At this point you will now start to make steady profits. You can either use these profits to further grow your loan portfolio to even greater levels or you can start to withdraw cash from your bank and use it to fund other industries:

Funding other industries and diversifying is important as this will lower the risks of your bank running out of cash or having a low capital ratio (as you can use the profits from your other industries to smooth out the temporary drops in profit caused by loan defaults). So I recommend diversification to improve the profitability of your banks and to lower the risks.

Some industries that I recommend expanding into:

- Media

- Retail/Industry

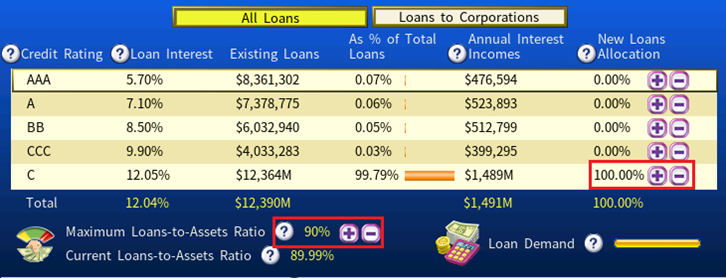

Once you are making a sufficient level of profit in those other industries you can afford to take greater risks with your loans such as setting the C (Highest Risk) loans to 100% and setting the Loan-To-Assets Ratio to 90%:

The reason why this strategy is very profitable is as follows:

- C Loans make the highest amount of profit; however when a recession comes along the default rate increases to levels so extreme that it causes the bank to run out of money and go bust and so it is normally a very bad idea to run a bank with only C loans.

- However if you are making money in other industries then you can transfer funds to the bank if it starts to run low (you can also borrow money and use your other industry’s profits to pay it back). In the short term you will lose money, however once the wave of defaults has passed the C loans turn out to be quite profitable in the longer term.

Setting up banks after establishing a prior company

This strategy will be focused on what to do if you wish to establish a bank after you have established a profitable business and want to make additional money.

In this case you will be establishing your bank in an environment where your competitors have already established a strong foothold in the banking industry. As a result I would suggest that if you are successful in other industries and want to build a bank you should consider the following:

- Are there other, more profitable opportunities outside of banking? After all you could still choose to use your funds to grow your business empire even further and earn an even greater return on investment. In general you can earn around 6% to 8% in profits if you set up a bank and use high risk C loans.

- Is your income stable and reasonably high? I would recommend having an annual profit of at least 200 million and about 500 million in cash. Make sure you have no outstanding debts as well, in case you need to borrow money in an emergency.

If you do decide to build a bank then some of the initial steps you would use to establish your bank can be skipped, as you will have enough money to increase the capital ratio of the bank to a high level.

After setting up the bank do the following:

- Transfer as much capital as you can into the bank, preferably at least 500 million to jump start the bank and increase the capital ratio to a high level.

- Set 100% of all loans to C, the highest risk loans.

- Set the Maximum Loan-To-Assets ratio to 90%.

- Don’t have any caps on the corporate deposit rate.

- Build as many branches as possible in every city you can, this may cost you hundreds of millions to do but it is important as a means of rapidly grabbing market share from your competition.

- Set the training level of all of your branches to the maximum level.

- Set up marketing in all of your cities or via a single internet company. Spend the maximum amount to advertise.

- Leave the deposit rate at the same level as that of your competitors.

At this point your bank should start rapidly lending all of the money you injected into it as well as the rapidly growing number of deposits. The bank should therefore start to become very profitable within only months; your bank will also start to slowly grab more and more market share, allowing you to grow the loan portfolio to a size much larger than that of your rivals.

Bank Troubleshooting

During play your bank may encounter a number of problems. Here are some of the common problems and how to prevent them (or get out of them if they occur):

Capital Ratio Too Low

You receive a message that your bank’s capital ratio is too low:

The cause of this is that the bank has loaned out too much money relative to the amount of equity in the bank.

The most common reasons this will happen are:

- Too many deposits have been added to the bank and had been loaned out, without sufficient build-up of equity capital.

- The bank is very unprofitable compared to how much money it is lending out. This can often happen if there a lot of defaults or the bank’s overhead is very large.

- Too much money is being transferred out of the bank.

To resolve this problem you will have to transfer money from outside the bank into the bank. You can do this either by using the profits of other industries to shore up your bank’s balance sheet or alternatively you can issue bonds/borrow from other banks/etc. and then use the money you make later on to pay back this debt. It should also be noted that you can borrow from your own bank and use that borrowed money to improve the capital ratio as well!

To prevent it happening in the first place:

- Limit the amount of deposits by stopping the acceptance of corporate deposits. If it is not corporate deposits but public deposits causing the problem you can reduce the amount by cutting back on training and advertising or reducing the deposit interest rate to make your customers withdraw their money from the bank, though be careful as you may run out of cash if you do this.

- Keep expenses low; don’t spend too much money on branches, advertising, training or deposits.

- Try increasing your bank income by increasing the number of high risk loans, although you should be careful about this due to the possibility of loan defaults later on.

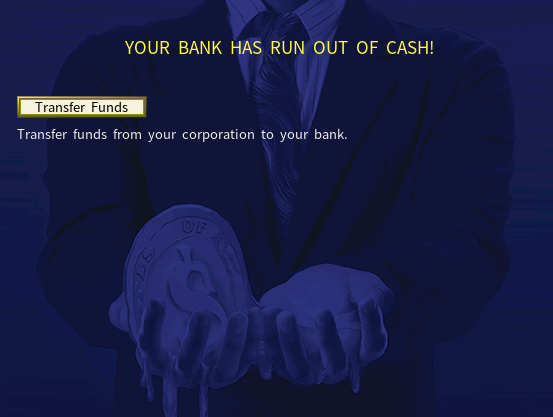

Bank is Out of Cash

You receive a message that your bank has run out of cash:

The cause of this is that the bank no longer has any cash on hand to pay for its expenses. You must transfer money to the bank to solve this issue.

Keep in mind that this is cash on hand, not the equity in the bank, so if money is deposited in the bank then the amount of cash on hand will be increased. If the money is loaned out, the cash on hand is decreased, even if neither transaction changes the total equity of your bank.

The most common reasons this will happen are:

- Deposits have been withdrawn from the bank; this can often occur if you decrease the interest payments on deposits. If the interest rates are lower than those of competitors, the depositors will take their money out and put it elsewhere.

- You are lending out too much money relative to your assets. This can happen if you set the Maximum Loan-to-Assets Ratio to a level at or close to 100%.

- You have a large number of sudden loan defaults, causing a sudden shortfall in cash. This often happens during economic downturns.

- You are spending too much money and your income cannot keep up.

To prevent it happening in the first place:

- Be careful about decreasing deposit interest rates. If you decrease the rate and see a sudden ‘Run’ on your bank, raise them again to stop the stampede of capital leaving your bank. Raise the deposit rates if need be to get more money in the bank.

- Limit the deposits you receive, especially from corporate depositors as these depositors can be somewhat temperamental and withdraw their money just when you have already loaned most of it out.

- Keep your Maximum Loan-to-Assets Ratio at 90% or lower to ensure that you always have a cash buffer. Lower this even further if the economy is doing badly.

- Keep expenses low; don’t spend too much money on branches, advertising or training.

- Try increasing your bank income by increasing the number of high risk loans, although you should be careful about this due to the possibility of loan defaults later on.

Loan Demand has fallen to zero

Sometimes you will notice that you no longer have any Loan Demand:

There are a few reasons this will happen:

- Your market share is too small – you need to construct additional branches, advertise and train more to attract more customers.

- You have stopped deposits – this will stop customers from putting more money in your bank but it also reduces your market share and therefore the customer base for loans.

- You have no branches at all. You need at least one branch to get any Loan Demand. A headquarters does not generate any loan demand.

- You have exhausted the capacity of the economy to absorb new loans – this only happens if your bank is very large or the economy is very small (such as in Survival Mode, in the City Economic Simulation DLC). Generally this will tend to happen once the outstanding loans are around 400% to 500% of GDP (if Realistic Loan Demand is on, the limit otherwise is much, much higher). At this stage you should either work on growing the economy or start limiting the amount of capital inside of your bank.

Conclusion

Banks in the Capitalism Lab Banking and Finance DLC are a powerful addition to the game which allows for a much more versatile and dynamic economy along with new and compelling ways to make additional profit. Banks can be used a steady and relatively stable source of income for your company as long as you are able to manage the expenses of the bank and keep a sufficient capital ratio to ensure that you can continue to issue loans. By choosing the right difficulty settings you can also fine tune the degree to which banks are challenging for you.